Private Client Insurance Solutions

An integral part of any financial planning process includes the evaluation of life insurance needs and the best manner to affect the long-term goals of the family while simultaneously focusing on preserving assets and minimizing possible tax liability. Not only is a strong plan necessary but so is flexibility for the plan to evolve as family situations evolve.

Over time we have learned that market conditions have a significant impact on insurance policy performance. Our administrative team actively manages life insurance portfolios to help minimize surprises that can emerge over time in a typical buy and forget scenario.

ZIPIssue™ (Zero Insurance Physical) Life and Disability Insurance

For our clients who meet specific demographic requirements, we have developed a next generation, multi-carrier program to meet the insurance needs of busy professionals. The plan offers flexibility in designing a wholesale priced life insurance policy with a focus on high cash value accumulation, death benefit coverage or long term care coverage with a simplified and condensed underwriting process for most eligible individuals.

Access to high quality, own occupation supplemental long term disability coverage is also available through the ZIPIssue™ program. Contact us and mention ZIPIssue™ in the subject line for more information.

Medical Auction Process (MAP™) for Policy Placement

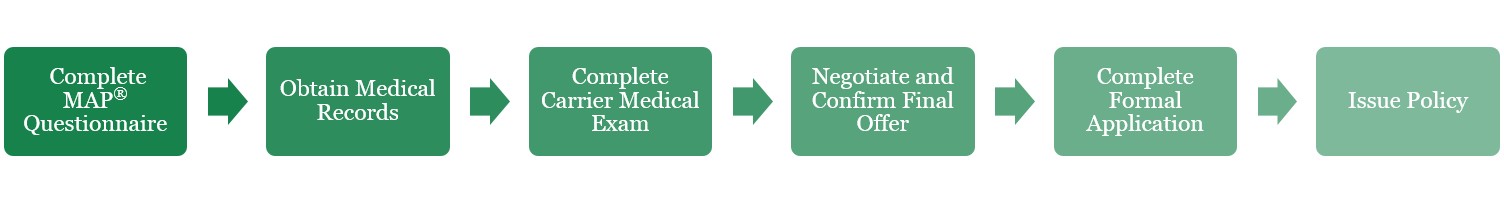

We have developed a proprietary Medical Auction Process (MAP™) to help minimize the hassle factor that is often associated with insurance underwriting and to create a high level of competition among the carriers based on actual client data.

We know that providing confidential personal information for the placement of life insurance is an act of trust that you place in us. We treat your personal information with the utmost privacy and handle the application process in a completely confidential manner.

We submit the underwriting information to the leading carriers from the Product Study. An Auction style process allows us to maximize the underwriting offers for the most suitable product(s) from the Product Study.

Through our relationship with M Financial Group, a number of carriers have reduced or simplified the usual medical requirements. Please contact us to learn more about the MAP™ process and some of the unique underwriting advantages currently available.

Private Placement Variable Life Insurance (PPVUL)

Our goal is to provide affluent individuals and corporate clients with customized insurance products that combine preferred pricing and distinct product design with nontraditional investment strategies.

Private placement variable life insurance, when combined with nontraditional investment options such as hedge fund strategies, represents a unique insurance solution for high net worth and corporate clients who expect institutional pricing and seek alternate investment options on a tax-favored basis.